Japan Fintech Week 2026

The Fintech Association of Japan (FAJ) and the Financial Services Agency (FSA) will co-host Japan Fintech Week 2026.

Japan Fintech Week 2026 will be held from Tuesday, February 24 to Friday, March 6, 2026, with the objectives of showcasing the strengths of Japan’s fintech ecosystem to a global audience and fostering new business opportunities that further drive fintech innovation.

By working with organizations hosting related events, Japan Fintech Week 2026 will serve as a central platform that brings together domestic and international fintech stakeholders to exchange ideas and explore collaboration opportunities.

See more information (Japanese only)

Event Exhibition

Singapore Fintech Festival

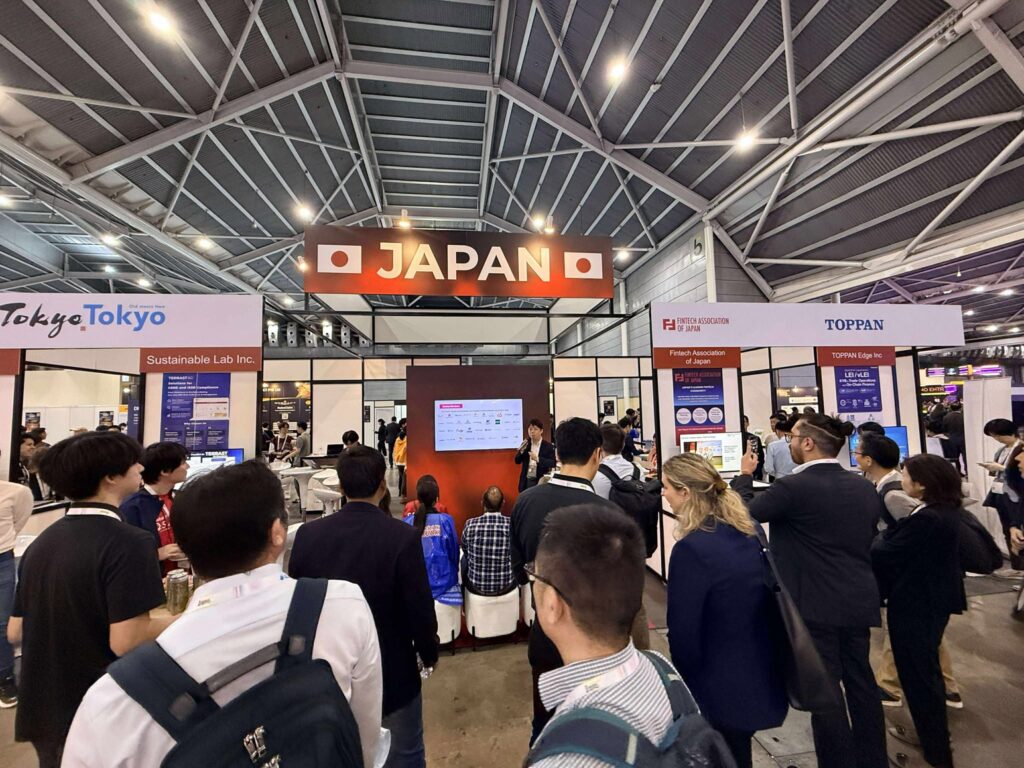

Since 2022, Fintech Association of Japan (herein after as FAJ) has organized the Japan Pavilion at Singapore Fintech Festival, forming delegations primarily centered on international Global Financial Cities.

Through this initiative, FAJ has been exhibiting together with Japanese companies, local governments, and organizations that aim to promote Japanese fintech companies overseas and attract global fintech businesses to Japan.

The Japan Pavilion has evolved and expanded each year.

In 2025, the initiative reached a new milestone with the successful hosting of on-site events within the Japan Pavilion, further enhancing engagement and visibility.

The pavilion and its events were well attended and concluded with strong positive outcomes, reinforcing Japan’s presence in the global fintech ecosystem.

Events with FSA

Casual Communication with FSA

At the Fintech Association of Japan, we provide opportunities for open and informal engagement with the Financial Services Agency through initiatives such as “Meetup with FSA”, support for hosting the Fintech Support Desk and online briefing sessions.

Fintech Meetup

Communicate Beyond the Industry

We have cross-industry events to share the latest trends in Fintech scene like DeFi, CBDC, Blockchain, AI…

We held panel-discussions with various organizations to discuss MaaS, Sharing Economy, SDGs, Digital ID.

Let’s find out the new types of Fintech with us.

Global Meetup

Communicate with Global Partners

We have concluded agreements with many global partners like Fintech Associations from overseas countries, ecosystem players, and event partners.

You can communicate with our partners and we can introduce you to the global players which you have an interest in.

Past events

・ Monthly Meetup